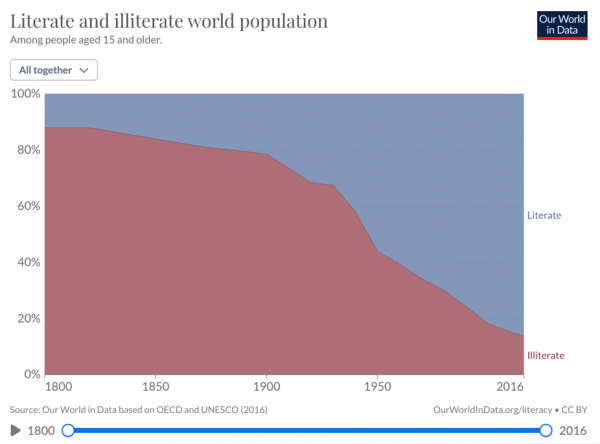

In a society whose population’s access to global news and information is exponentially growing, political and financial literacy have become increasingly valuable commodities, rising in merit in conjunction with a rising literacy rate (figure 1), which globally, in the year 1900, was only at 21.40%. In the century following, literacy rates quadrupled in magnitude to a value of 81.90%, a staggering rise which, by most, is viewed with an optimistic perspective in regard to future development.

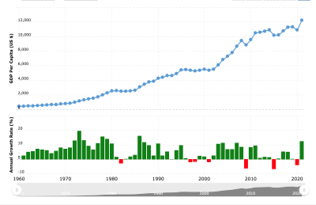

However, despite the technological advancements of modern society, maintaining steady rates of political and financial literacy – especially among youth – has proven difficult. With increasing dependence on social media as a news outlet amongst teenagers, political literacy, which is defined as “a set of abilities that are required for citizens to participate in a democratic society”, has become significantly harder to enforce without the infiltration of “fake news” or bias. Additionally, with a general growth of Gross Domestic Product (GDP) worldwide (figure 2), financial literacy, which is defined as “the knowledge and skills needed to make important financial decisions” has become progressively relevant amongst the earth’s general population.

But why has it become so difficult to provide modern-day teenagers with trustworthy resources to ensure financial and political literacy? Should it be a nation’s educational system’s responsibility to enlighten students, or is literacy beyond reading a skill an individual is obliged to personally choose to develop?

While there are increasing numbers of children receiving both primary and secondary education and a higher percentage of students pursuing further education, financial literacy has become more relevant to ensure personal independence and autonomy. However, a recent study confirmed that 75% of American teenagers lack confidence in their knowledge of personal finance, and a baffling 73% of teens reported wanting more personal finance education in 2021. While children are taught to read and write, build fundamental mathematical skills, and retain basic scientific knowledge, schools often fail to prepare students for the more practical financial skills such as filing taxes, investing, and saving, resulting in struggles in their adult life. Without necessary knowledge of budgeting, saving, investing and more, it is likely teenagers will struggle with money management in their adult lives, garnering easily avoidable issues that would reverberate throughout the world’s economy.

On the opposite side of the spectrum, the rise of social media, which 48% of people aged 18-29 in the USA reported as their primary news source, has provoked issues in ensuring political literacy. The prevalence of bias, false information, and propaganda has grown, and the validity of news has become increasingly difficult to regulate due to all people gaining opportunities to publish personal opinions online. Subsequently preventing developing minds from formulating individual views that have not been influenced by external factors. Furthermore, the rise of “short-form” video content through social media networks like TikTok and Instagram has lowered attention spans as consumers seek a dopamine rush, resulting in them not fully registering information, hence establishing false preconceptions or unfounded ideas, diminishing political literacy. Short-form media content has also contributed to increased political polarisation and confirmed predisposed biases, reducing people’s openness to new ideas.

Moreover, ideas of “herd mentality” and easy access to voicing hateful comments online create almost a stigma amongst publicly stating opinions that go against the “general” point of view, therefore creating a “false” political literacy often built on baseless arguments and a loss of freedom of speech. Studies have demonstrated that only 5% of individuals are needed to influence a group to follow them, and with the correct resources and attractive marketing, dated and controversial ideas have remained in circulation, leading to heightened senses of stress as people conceal their true values due to fear of polarisation. A lack of transparency amongst adults and youth regarding finance builds barriers and prevents financial literacy growth, fostering a generation lacking preparedness for adulthood and hindering people from maximising their potential.

While several reforms in education systems worldwide have taken place over the past several decades, with subject choices such as business management, economics, politics, and accounting becoming more widespread, most youth report receiving their financial and political literacy from their parents, and most lack confidence in their knowledge. To ensure future generations avoid issues being faced by modern youth, a basic level of education in economics, finance, and politics should be mandatory in all countries. Stigma regarding discussing finance can be broken down individually within families and on a global level through encouraging open communication and developing educational resources available to all. Additionally, encouraging people to disagree with predisposed political opinions regardless of the views of people surrounding them may ensure the development of new perspectives and improve political literacy by heightening interest in world affairs.

Sources and recommended reading:

https://cuatower.com/2021/04/the-importance-of-political-literacy-in-an-increasingly-illiterate-age/

https://www.annuity.org/financial-literacy/financial-literacy-statistics/

https://gflec.org/wp-content/uploads/2015/11/3313-Finlit_Report_FINAL-5.11.16.pdf

https://files.eric.ed.gov/fulltext/EJ1368828.pdf